The 5 Biggest Mistakes First-Time Homebuyers Make

Do you really need to put 20% down? Not necessarily; there are low- and no-down-payment loans that will let you get your foot in the home-ownership door a lot sooner.

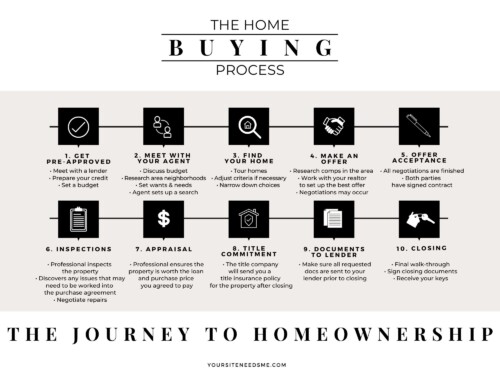

It pays to figure out what you can actually afford — and that means getting pre-approved for a home loan. (Prequalification isn’t enough.)

You may wonder why a real estate agent is even necessary. But in areas with red-hot markets, you’re not seeing the most updated listings, and you’re missing out on expertise around where to look.

See if you can find an Airbnb where you can crash for a night or two – preferably closer to a week – so you can try your new neighborhood on for size.

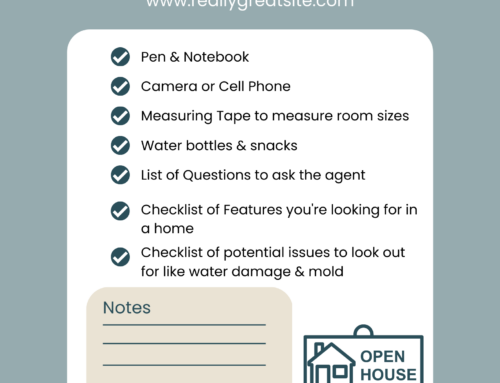

Drop panels in the ceiling and that minuscule bathtub – ugh! Are those annoyances that can be fixed or deal-breakers that mean you should pass on the property entirely? In markets where entry-level homes are getting snatched up as soon as they hit the market, knowing what’s acceptable and what you just can’t take is a huge advantage.

None of these mistakes will keep you from buying a home of your own – but they could delay the process and cost you hundreds (if not thousands) of dollars at the end of the day. But if you’re able to avoid them, you’ll be signing the closing papers on your dream home before you know it!